Table of Content

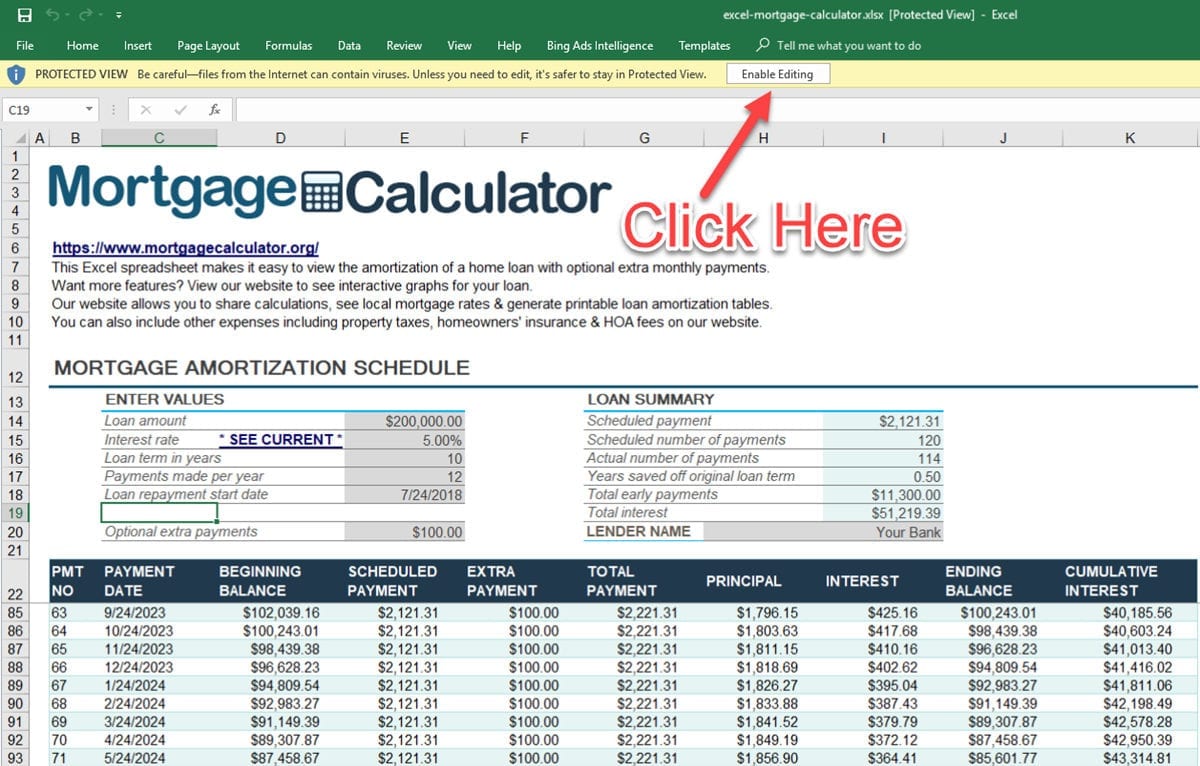

Below, you can see how a VA loan differs from a conventional 30-year fixed mortgage. The table below brings together a comprehensive national survey of mortgage lenders to help you know what are the most competitive VA loan rates. This interest rate table is updated daily to give you the most current rates when choosing a VA mortgage home loan. APR is typically higher than your base VA loan interest rate.

You won’t find the VA publishing interest rates, APR information, or other data–that is something you will need to research with each participating VA lender. Be sure the sales contract includes the “VA escape clause” or “VA option clause.” This provides an option to void the contract if the property doesn’t appraise for the contract price. Get recommendations for potential real estate agents online or from relatives, friends, and neighbors. You’ll need to show your COE to your lender as proof that you qualify for the home loan benefit. Interest rates are kind of wild right now but generally they are lower since they are government backed. Find out if you can get a Certificate of Eligibility for a VA-backed or VA direct home loan based on your service history and duty status.

How will I pay this fee?

Yes, but several other factors also affect the amount of your mortgage payments. For example, refinancing to a shorter loan term could increase your monthly mortgage payments. But you’d be paying less interest over the life of the loan. If you’re refinancing an existing VA loan simply to reduce your mortgage payments, consider the IRRRL Streamline loan first.

The interest rate is just one fee included in your mortgage. You’ll also pay lender fees, which differ from lender to lender. Both interest rate and lender fees are captured in the annual percentage rate, or the APR. This week the APR on a 30-year fixed-rate mortgage is 6.82%. Third, keep in mind thatInterest rates on VA home loans are generally lower than conventional loans – but they’re not always the lowest available.

How many different types of mortgages are there?

Upfront closing costs for refinancing are typically 2 to 5 percent of the loan amount. VA loans are unique because the lender’s origination fee can’t be more than 1 percent of the loan amount. Most homeowners use some of their cash-back to pay closing costs so they don’t have to pay out of pocket. While it is a commonly-held belief that VA loans have lower interest rates than conventional loans, that’s not necessarily true. Financial institutions that cater to veterans and active-duty personnel may offer lower interest rates compared to conventional loans.

Eligible veterans and service members find that rates are generally lower with a VA home loan than a conventional mortgage. Different lenders offer different mortgage rates, so it’s essential to shop around. To find out what lenders provide at any given time, browse our rate table.

The Best Time to Get a VA Home Loan

Our own mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates and/or annual percentage yields. The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement. In the end, what the veteran needs to keep in mind is that there will be an additional cost, of course, to refinance this loan under this new tier. And so they’ll need to keep in mind the closing costs because it is up to the lender what closing costs they charge. The lender may even charge the VA funding fee to the veteran. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Selecting a longer term would mean lower monthly payments but higher interest rates. If you’re eligible, a VA loan is typically better than an FHA loan. You’re likely to get a lower rate, and you won’t have to pay mortgage insurance every month. If you’re not eligible for a VA loan, however, an FHA mortgage is a good low-down-payment alternative. You don’t need a down payment for a VA loan, but you’ll likely get a lower mortgage rate if you can provide one. This saves you money both by lowering your interest rate and reducing the loan amount you’re paying interest on.

Compare lender fees

You must get your COE, satisfy the lender’s requirements, and meet all the MPRs. Veterans are in the clear, but if you are an active military member, you might get a PCS. Generally speaking, the best time to borrow a loan is when you know you can afford it. You might also want to spend some time on improving your credit score before applying so you can get the best quote.

In New York State it is licensed by the Department of Financial Services. Please click here if you do not wish us to sell your personal information. If you take the time to do both, you’re likely to end up with a lower interest rate — something that could save you thousands of dollars over the life of your VA loan. The lender wants to know your employment is stable and that you’ll have a reliable income stream to repay the loan. DTI affects the amount you can borrow but it’s also key to determining your interest rate.

In addition to your credit score, lenders will also look at your debt-to-income ratio. Your DTI is your gross monthly income and the total of your monthly debts, including your new mortgage payment. VA loan lenders typically prefer a DTI ratio of 41 percent or lower. Although home ownership is typically cheaper than renting in the long run, in many parts of the country, renting is substantially cheaper on a monthly basis. In Austin, Texas, for example, renting could save you an average of $1,822 per month compared to buying, Realtor.com data shows. Depending on your location, it may make more financial sense to keep renting and use the savings to build up a bigger down payment.

Department of Veterans Affairs, providing an excellent solution for military service members and their families when looking to buy a home. Adjustable-rate mortgages usually have lower interest rates than fixed-rate mortgages, which can mean lower monthly payments. After an introductory period ranging from one to 10 years, the interest rate is regularly adjusted based on current interest rates.

Now, we apply our 6% interest rate to get a new monthly principal and payment of $1,834.62 – again, a 6.00% NOTE rate. Review the VA funding fee rate charts below to determine the amount you’ll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing. Currently I am in two separate repayment programs for those with defaulted student loans.

No comments:

Post a Comment